closed end loan examples

How Open-End Credit Works. Payments are usually of equal amounts.

Request Letter To Bank For Closing Loan Account 5 Samples 2021 New Format

Ad Create a Personalized Loan Contract That Outlines Your Payment Terms.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

. Generally with closed-end credit the seller retains some form of control over the ownership title to the goods until all. H-14 Variable-Rate Mortgage Sample 102619b H-15 Closed-End Graduated-Payment Transaction Sample. For example closed-end mortgages restrict the borrower from using the home equity they have built as collateral for additional financing.

Examples of closed-end loans. You borrow money for a specific purpose such as paying for a car or house and then you make monthly payments until its paid off. A closed-end loan is also known as an installment loan by traditional lenders.

Mortgage loans and automobile loans are examples of closed-end credit. Another source of credit is credit card companies like visa mastercard American express and discover. Closed end credit is a loan for a stated amount that must be repaid in full by a certain date.

H-13 Closed-End Transaction With Demand Feature Sample. Fill Out and Download Your Professional Agreement Today. Why It Is Important.

60 monthly payments of 3025 per 1000 borrowed These examples can be incorporated into the body of the advertisement or reference in the disclosures. Closed - end credit is used for a specific purpose for a specific amount and for a specific period of time. Open-end credit on the other hand is revolving credit that allows you to continually access money as you make payments and only pay interest on what you use.

36 to 72 month auto loans. These loans are normally disbursed all at once in order for the debtor to buy or achieve a specific thing and often the creditor gains rights to possess the item if the debtor fails to repay the loan. Compare offers from our partners side by side and find the perfect lender for you.

May the Best Loan Win. Personal loans are also often close-end. So if a borrower is 15 years into a 30-year closed-end.

When you borrow money with a closed-end loan you are agreeing to make installment payments which include principle and interest divided in equal amounts and applied to a repayment schedule. The sum of money borrowed as part of the closed-end loan is explicitly designated for the purchase in question. A closed-end loan is to be contrasted with an open-ended loan where the debtor borrows multiple times without a specified repayment date like with a credit card.

A closed-end mortgage loan or an open-end line of credit whose funds will be used primarily to improve or expand a business for example to renovate a family restaurant that is not located in a dwelling or to purchase a warehouse business equipment or inventory. An example of closed end credit is a car loan. Mortgage loans and automobile loans are examples of closed - end credit.

Ad A Loan for Almost Anything. Closed-end loans are installment loans. An agreement or contract lists the repayment terms such as the number of payments the payment amount and how much the credit will cost.

RV loans up to 108 months. Closed end credit has a set payment amount every month. Payments on a Closed-End Loan.

For a 25000 auto loan for a term of 60 months with a 275 APR the monthly payment will be _____ A repayment example may also be stated as a unit cost. Mortgages auto payments and student loans are the most common. Ad Create a Custom Loan Contract to Ensure Payment Within a Specified Time Period.

H-17B Debt Suspension Sample. Ad Find Your Ideal Offer Get 1K - 50k in 24 Hours. Examples Examples of closed-end loans typically appear in installment loans.

Payments are usually of equal amounts. 10 20 or 30 year mortgages. Save Money Quickly With a Low Fixed Rate Loan.

Auto loans student loans and mortgages. H-11 Installment Loan Sample. Professional and Secure Legal Solutions Personalized by You.

Secure a Loan without Stress. Get Free Offers Explore Loan Options from Top Lenders. Fast Results Done Right.

If you take out an installment loan such as an auto loan this is a form of closed-end credit with a fixed interest rate and payment. In each scenario the borrower will receive a loan that is equitable to the cost of the item they are buying be it a new home or a car. An example of a closed-end loan is a mortgage loan.

They have a set interest rate usually determined by the credit score and other financial information provided on the loan application. Ad Our Trusted Reviews Help You Make A More Informed Refi Decision. Some of the most common examples of closed-end loans used today are home mortgages and auto loans.

Also Know what are the three most common types of closed. Closed-end loans are probably what you think of when you imagine a traditional loan. When you borrow money you make.

H-17A Debt Suspension Model Clause. For example a car company will have a lien on the car until the car loan is paid in full. Closed-End Credit Disclosure Forms Transactions under 102619e f For a closed-end credit transaction subject to 102619e and f opens new window determine whether the credit union provides disclosures required under 102637 opens new window Loan Estimate and 102638 opens new window Closing.

Hdfc Bank Personal Loan Closure Letter 2 Samples Format

Truth In Lending Act Tila Consumer Rights Protections

What Are Open Ended Close Ended Questions Definition Examples Writing Explained

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Closing Your Loan Account Do These Things First Loan Account Finance Loans Loan

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

What Are Closed End Funds Fidelity

Education Loan Closure Letter 3 Samples Format

How Much A 450 000 Mortgage Will Cost You Credible

Understanding Finance Charges For Closed End Credit

A Complete Guide To Investment Vehicles Money For The Rest Of Us

/balloon-loans-315594-cadd06e3bbe046d39311cd4be59d794c.gif)

How Balloon Loans Work 3 Ways To Make The Payment

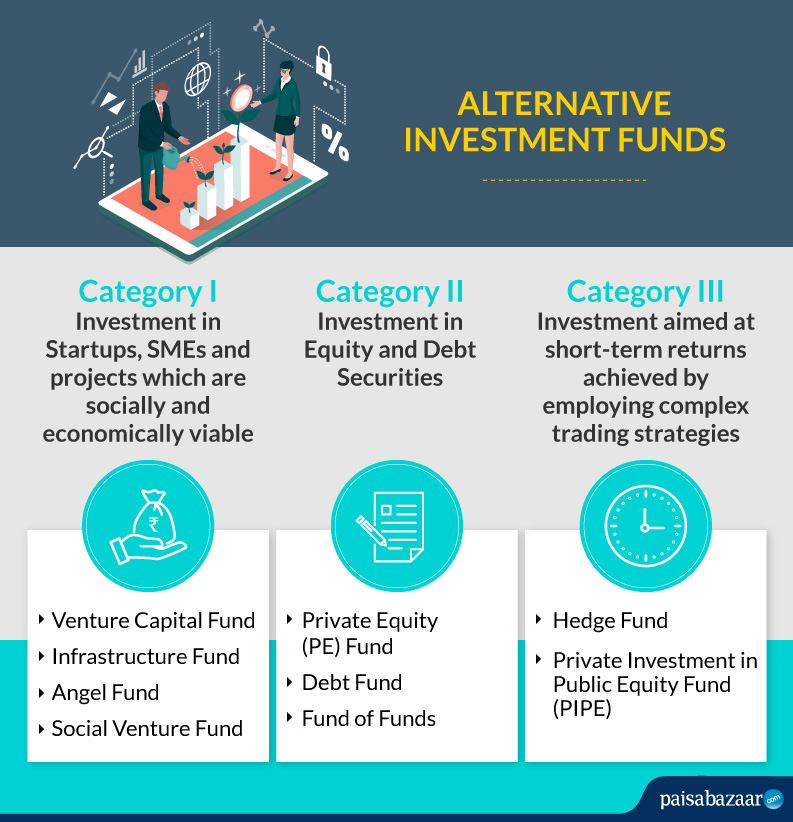

Alternative Investment Fund Know Types Taxation Rules List Of Best Aif

Closing Disclosure Calendar 2020 Image

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

/155571944-5bfc2b9646e0fb005144dd3f.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)