monterey county property tax due dates

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and. All major cards MasterCard American Express Visa and Discover are accepted.

Contact Us United Way Monterey County

Second installment of secured property taxes is due and payable.

. Opry Mills Breakfast Restaurants. Through Friday from 900 am. PROPERTY TAXES IS THIS FRIDAY.

The tax due date may change each year. Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

The history of Town of Monterey is also that of Tyringham as Monterey or South Tyringham was not separated and incorporated as a separate town until 1847. Monterey County Property Tax Due Dates. Monterey county property tax due dates 2021 Monday May 16 2022 Edit 2nd Installment - Due February 1st Delinquent after 500 pm.

Post Office Box 390. A convenience fee is charged for paying. District 5 - Mary Adams.

Last day to file a claim for deferment of property taxes under the. 630 pm pdt apr 8 2020. 630 PM PDT Apr 8 2020.

May 7 Last Day to file business property statement without penalty July 1 Start of the Countys fiscal year. If you see issues with the property tax. The installments due dates for fiscal 2021-2022 tax year are.

Monterey County collects on average 051 of a propertys assessed fair market value as property tax. Secured property taxes are levied on property as it exists on January 1st at 1201 am. Monterey County Property Tax Due Dates.

Yes you can pay your property taxes by using a DebitCredit card. Restaurants In Matthews Nc That Deliver. Not only for Monterey County and cities but down to special-purpose districts as well eg.

A 10 penalty plus an additional 2000 cost is. Clerk of the Board. Discover Calif Property Taxes Due Dates for getting more useful information about real estate apartment mortgages near.

Real Estate Personal. Second-half real estate taxes are scheduled to be due Friday July 15. This due date is set by the Assessor and may vary.

BOE-571-F2 Registered And Show Horses Other Than Racehorse BOE-571-J Annual Racehorse Return BOE-571-J1 Report Of Boarded Horses. District 3 - Chris Lopez. For taxes entered to the unsecured roll as a result of a second change of ownership before the supplemental billing is made the taxes shall become delinquent on the last day of the month.

This due date is set by the Assessor and may vary. Treasurer-Tax Collector mails notices for delinquent secured property taxes. Taxcollectorcomontereycaus I certify or declare under penalty of perjury that the foregoing is true and correct.

The second payment is due September 1 2021. Monterey County Treasurer - Tax Collectors Office. Second installment of secured property taxes payment deadline.

Sewage treatment plants and athletic parks with. District 1 - Luis Alejo. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of.

Tax bills are generated every fiscal year July 1 through June 30 and mailed in mid-October and payment may be made in two. First half of real estate taxes are scheduled to be due Friday February 18 2022 in the Treasurers Office. As computed a composite tax rate.

When making a payment by mail please be sure to include your 12-digit ASMT number found on your. IN MONTERE COUNTY THE TAX COLLECTOR THERE SAYS HER. The state relies on real estate tax revenues a lot.

Monterey County Treasurer - Tax Collectors Office. District 4 - Wendy Root Askew. You must check the Monterey County Assessor website for details on how to pay online in-person or by mail.

Publish notice of dates when taxes due and delinquent. July 1 Oct. District 2 - John M.

April 10 Last day to pay 2nd installment of property taxes without penalty. You can call the Monterey County Tax Assessors Office for assistance at 831-755-5035. Or e-mail us at.

BOE-571-F2 Registered And Show. On or before November 1. 15 Period for filing claims for.

Gis Mapping Data Monterey County Ca

Monterey County Cannabusiness Law

At A Glance Monterey County Monterey County Ca

Calfresh Monterey County 2022 Guide California Food Stamps Help

Monterey County Fire Relief Fund Community Foundation For Monterey County

Monterey County Ca Property Data Real Estate Comps Statistics Reports

Monterey County Destination Reps

A Message From Monterey County S Treasurer Tax Collector The Deadline For Second Installment Of Property Tax Is April 10th Monterey County Mdash Nextdoor Nextdoor

Monterey County California Offers 22 New And Revamped Experiences For Travelers In 2022

Calfresh Monterey County 2022 Guide California Food Stamps Help

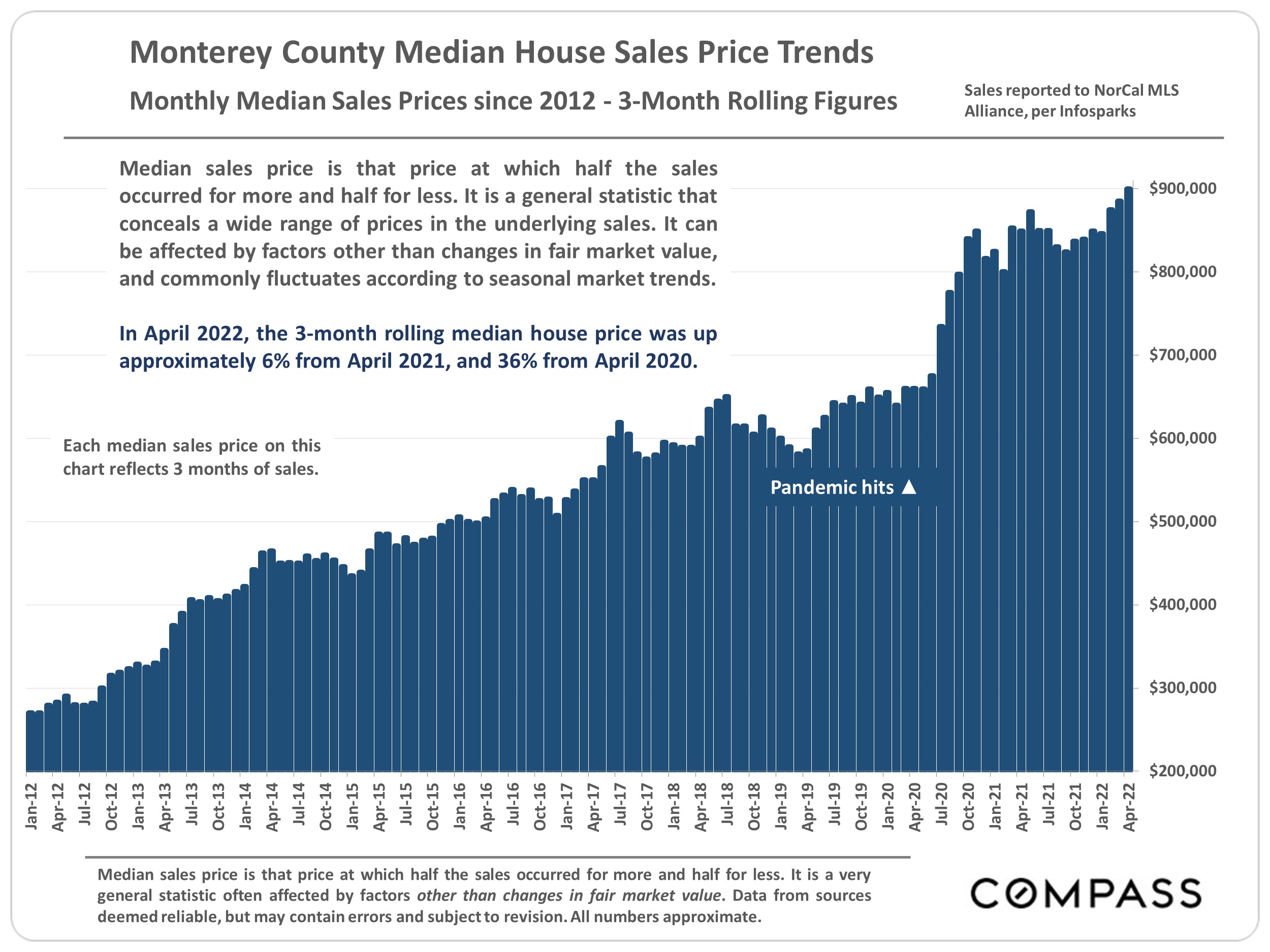

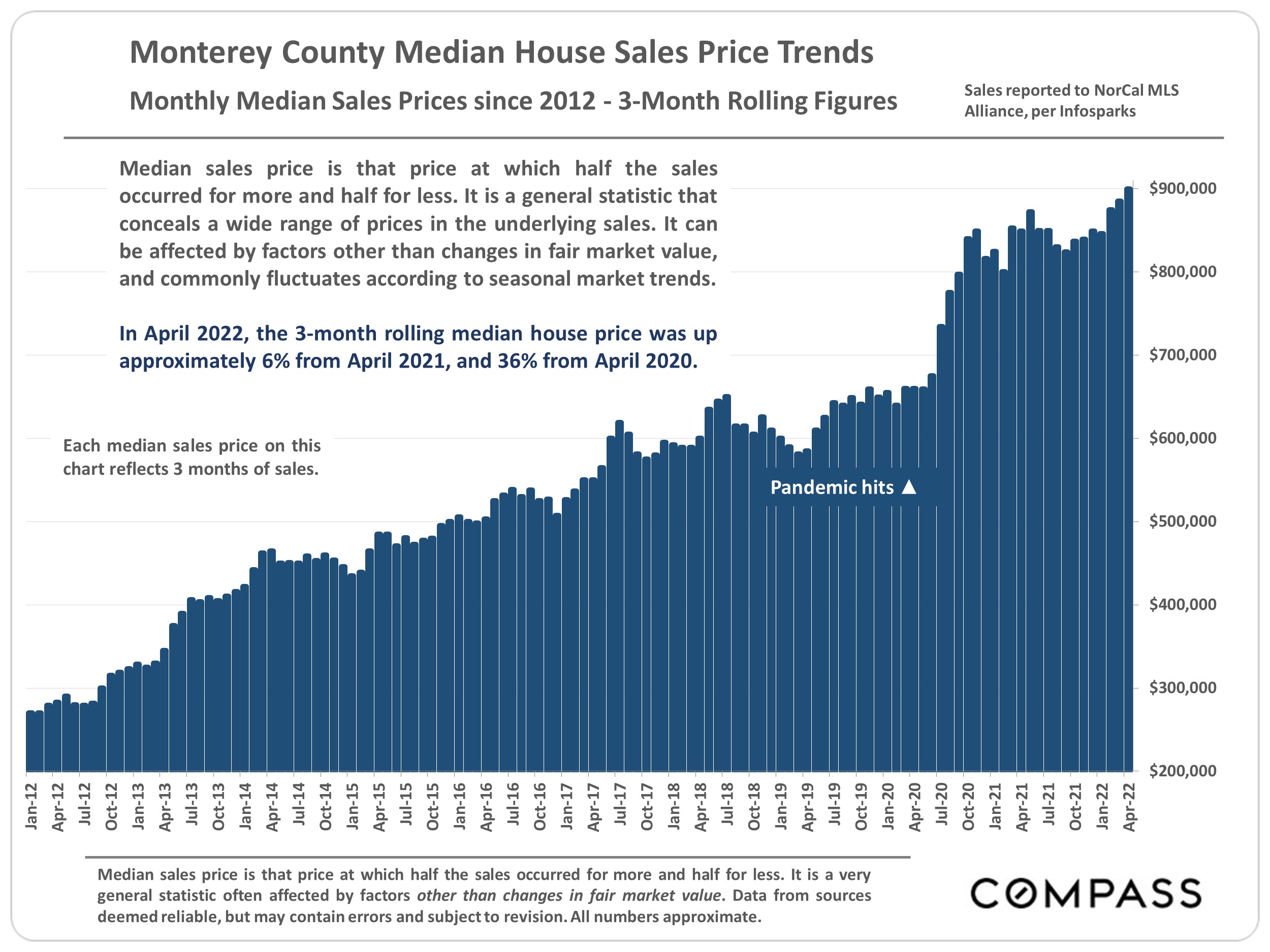

Monterey County Home Prices Market Trends Compass

Monterey County California Fha Va And Usda Loan Information

Monterey County Regional Fire District

2022 Best Places To Buy A House In Monterey County Ca Niche

The California Transfer Tax Who Pays What In Monterey County

Contact Us United Way Monterey County

Monterey County Approves Fines For Face Covering Order Violations News Information Monterey County Ca