nc estimated tax payment calculator

Learn More GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. For details visit wwwncdorgov and search for online file and pay For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and.

Quarterly Tax Calculator Calculate Estimated Taxes

Pay individual estimated income tax.

. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. North Carolina Estate Tax. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes.

This safe harbor is generally 100 of the prior years tax liability. If you are unable to file and pay your north carolina estimated tax electronically or want to use a paper form visit download forms and instructions to access instructions and download the paper form. North Carolina repealed its estate tax in 2013.

PDF 49105 KB - January 24 2022. This North Carolina hourly paycheck calculator is perfect for those who are paid on an hourly basis. Overview of North Carolina Taxes.

April 15th payment 1 June 15th payment 2 September 15th payment 3. The calculator should not be used to determine your actual tax bill. All data based on your calculation.

North Carolina DMV fees are about 585 on a 39750 vehicle based on 108 in registration fees plus a vehicle property tax that varies by weight and location. Schedule payments up to 60 days in advance. Make one payment or.

If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498. Use the Create Form button located below to generate the printable form. Contact your county tax.

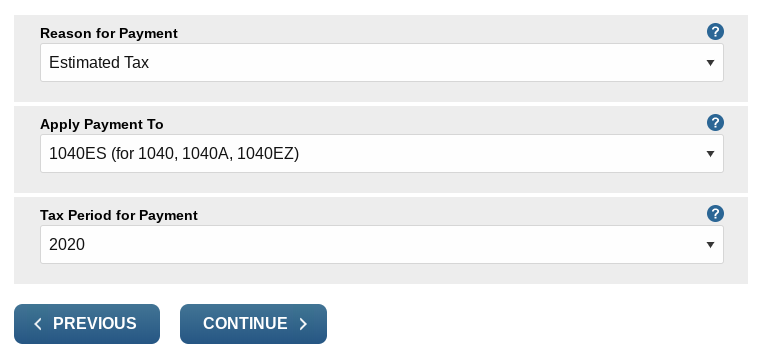

Experian 2020 Q1 data published on August 16 2020 Across the industry on average automotive dealers make more money selling loans at inflated rates than they make from selling cars. To pay individual estimated income tax. Use eFile to schedule payments for the entire year.

How To Calculate Payroll Taxes Methods Examples More Created with Highcharts 607. The average effective property tax rate in North Carolina is 077 well under the national average of 107. 285 general sales tax.

Calculating your North Carolina state income tax is similar to the steps we listed on our Federal paycheck calculator. View the North Carolina property tax estimator to verify your cost add 108 and use the DMV Override to adjust the calculator. Effective tax rate 150.

Once youve used our estimated tax calculator to figure out how much you owe making the payment is fairly straightforward and takes less than 15 minutes. You can also pay your estimated tax online. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

The act went into full effect in 2014 but before then North Carolina had a three-bracket progressive income tax system with rates ranging from 6 to 775. Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user. Breakdown of North Carolina tax dollars in 2017.

This calculator is designed to estimate the county vehicle property tax for your vehicle. Do not print this page. This statistic puts the state in 24th place for highest taxes in the country not a bad place to be.

Income tax you expect to owe for the year. Before you sign a loan agreement with a dealership you should contact a community credit union or bank and see how they compare. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

45 personal income tax. Individual estimated income tax. How To Calculate Estimated Taxes The Motley Fool.

In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies. Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax. 7 Mail the completed estimated income tax form NC-40 with your.

2021 Form Sc Dor. Appointments are recommended and walk-ins are first come first serve. North Carolina Gas Tax.

2022 Form NC-40pdf. North Carolina tax year starts from July 01 the year before to June 30 the current year. The individual income tax estimator helps taxpayers estimate.

Country if not US Payment Amount whole dollar amounts 00. If you did not receive a payment confirmation page do not resubmit your payment. Youll need to make the payments four times per year according to these due dates.

What is individual estimated income tax. Want to schedule all four payments. Enter Your Status Income Deductions and Credits and Estimate Your Total.

Your county vehicle property tax due may be higher or lower depending on other factors. 28 corporate income tax. So the tax year 2021 will start from July 01 2020 to June 30 2021.

North Carolina Income Tax Calculator 2021. North Carolinas property tax rates are relatively low in comparison to those of other states. North Carolinas statewide gas tax is 3610 cents per gallon for both regular and diesel.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. After a few seconds you will be provided with a full breakdown of the tax you are paying. To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Switch to North Carolina salary calculator. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Individual Estimated Income Tax.

Please enter the following information to view an estimated property tax.

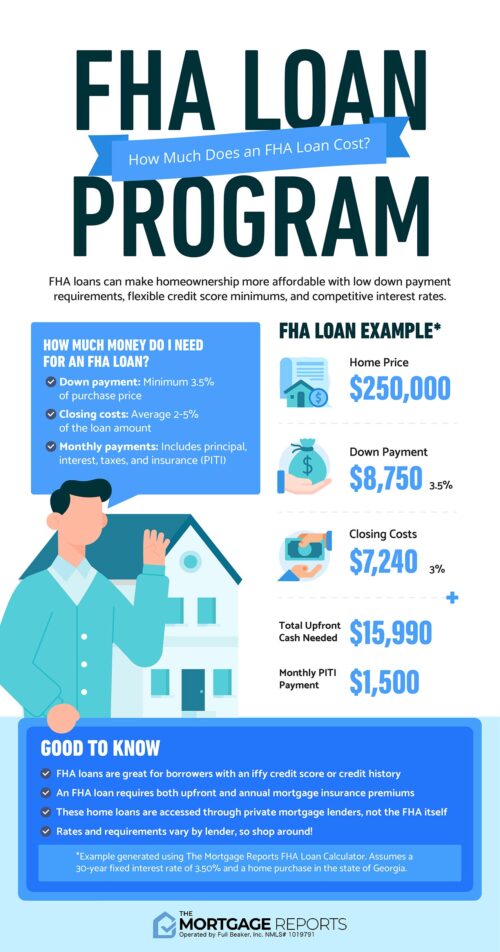

Fha Loan Calculator Check Your Fha Mortgage Payment

Tax Calculator Estimate Your Taxes And Refund For Free

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

North Carolina Sales Tax Small Business Guide Truic

Quarterly Tax Calculator Calculate Estimated Taxes

North Carolina Income Tax Calculator Smartasset

Tax Calculator Estimate Your Taxes And Refund For Free

How Much Should I Set Aside For Taxes 1099

North Carolina Providing Broad Based Tax Relief Grant Thornton

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

North Carolina Income Tax Calculator Smartasset

Tax Calculator Estimate Your Taxes And Refund For Free

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Llc Tax Calculator Definitive Small Business Tax Estimator

Online File Pay Sales And Use Tax Due In One County In Nc Youtube